Guide to Car Buying

A car purchase is one of the most significant financial decisions you’ll ever make. There are many options available, and distilling those options can feel daunting. How do you make a smart decision?

Let’s break this decision down into a few key categories:

- Practicality vs Performance

- Safety

- Reliability

- Depreciation

- Ongoing costs

Practicality vs Performance

At a basic level, a car is a mode of transportation designed to move you and your family to places you want to go. Practical items to think about:

- How many seats do you need?

- How much trunk space do you need?

- What type of climate will you be driving in? Do you need 4 wheel drive?

- How comfortable do you feel in the cabin?

- Will you be towing trailers or other items?

- Which technology features are a must-have?

Many people derive joy from the driving experience. However, performance and luxury come at a higher price.

How much do you value the following items?

- Acceleration

- Cornering

- Suspension

- Interior materials

- Premium audio

- Exterior design

Brainstorming how the car will be used and which features you value will allow you to pinpoint your target vehicle quickly.

Safety

As technology improves over time, safety features in cars will continue to improve. Many auto manufacturers are standardizing features such as: backup cameras (mandatory for new cars sold after March 2018), lane departure warnings, blind-spot sensors, forward collision sensors/automatic braking, adaptive headlights, etc.

The IIHS publishes vehicle safety ratings based on how cars perform in crash tests and the safety features they have. Make sure the car you’re considering purchasing does not have a poor IIHS rating.

Reliability

Repairs have a considerable impact on long-term ownership costs. Separately, taking your car to the shop constantly is inconvenient and frustrating.

Certain automakers have a reputation for high quality. Over the past few years, the most reputable brands have included: Toyota/Lexus, Mazda, Honda, and Porsche.

Some German luxury automakers (eg Mercedes, BMW) have developed a reputation for high repair costs due to expensive replacement parts. Keep this in mind if you’re considering buying used.

You can find reliability ratings for your desired vehicle using sites such as Consumer Reports. Avoid makes and models with historically poor reliability ratings.

Financial

If we look at cars through a financial lens, cars are a rapidly depreciating asset class. On average, new cars lose about 20% of market value to depreciation in the first year of ownership. In the 2nd year and every following year, the depreciation rate is approximately 15%. Three years after a new car purchase, the car is worth about 60% of what you paid for it. Five years after purchase, the car is worth about 42% of what you paid for it.

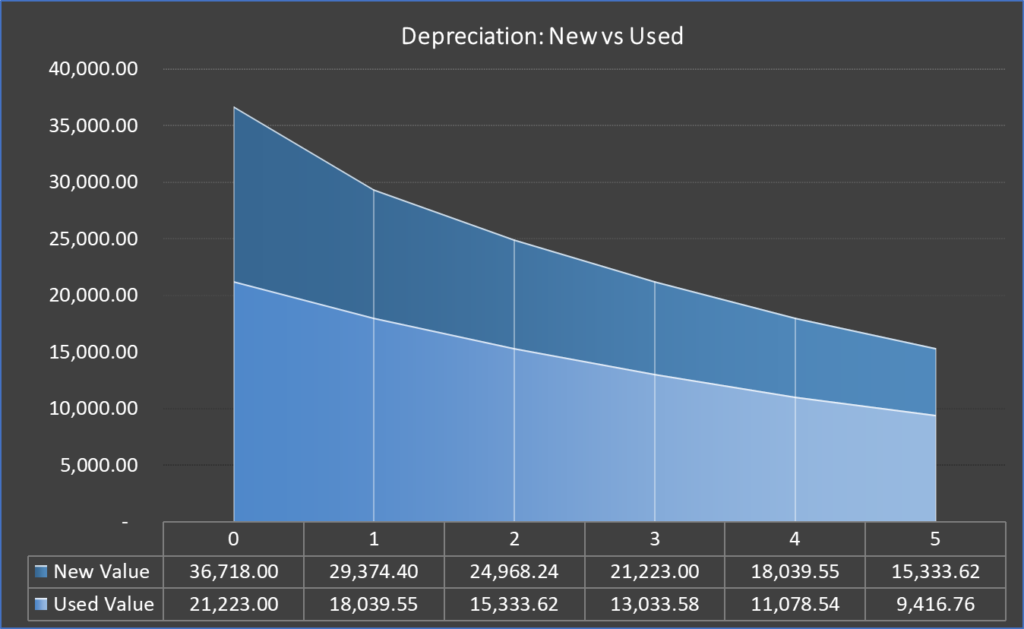

In May of 2019, the average price of a new car purchased in the U.S was $36,718. The chart below illustrates the impact of depreciation over time for a new car versus a 3 year old used car.

The new car lost $21,384.38 due to depreciation over the 5 year period. Meanwhile, the used car lost $11,806.24 over the same period.

When buying a new car, consider that you’re paying a substantial premium to drive a new car for the first 2-3 years. Avoiding new car depreciation in the first few years can result in substantial ownership savings. A common strategy involves purchasing lightly used, low mileage, reliable vehicles. This would result in a lower monthly car payment, allowing you to invest more funds into appreciating assets.

Ongoing Costs

Ongoing maintenance costs also contribute to your overall cost of ownership. These can include: oil changes, tire replacements, fluid flushes, and other items on the manufacturer’s recommended maintenance schedule.

You’ll also have the cost of gasoline (or electricity for electric vehicles). Many people consider fuel economy to be a major factor in their overall decision process.

- What is the car’s fuel economy (ie MPG or MPGe)?

- How many miles per year do you expect to drive?

- What is the average price per gallon of gasoline in your area (or cost of electricity)?

You’ll need to insure the vehicle. Expensive cars and faster cars typically require a higher monthly auto insurance premium. Ask your auto insurance agent for an estimate of the auto premium prior to purchasing the vehicle.

If you plan on borrowing money to purchase the vehicle, financing will be an additional ongoing cost. Before going to the dealership, I suggest getting pre-approved at an outside bank, so you don’t need to rely on in-house dealership financing. This will require rate-shopping (comparing auto loan rates) at various lenders.

Final Thoughts

Consider test driving at least 3 vehicles after you’ve narrowed down your list. A specific car may check all of your boxes, however it may not “feel right” during the test drive. You’ll likely be spending a lot of time in your car. You should feel comfortable inside.

There are online tools that can help you estimate the total costs of car ownership and compare them to other vehicles on your list. A popular tool is Edmunds True Cost to Own (TCO).

If your goal is to build wealth, consider minimizing the costs of vehicle ownership (depreciation, ongoing costs, financing), while making sure the vehicle safely meets your family’s needs. The more you can contribute to a diversified portfolio, the sooner you’ll reach financial independence.